Contact Us

Bravo Capital has provided over $1.6 billion in bridge, HUD and mezzanine financing to multifamily and healthcare properties across the country. Our expert team treats each project with the attention it deserves, offering tailored financing solutions to best fit your unique transactional objectives.

Representative Recent Transactions

Bravo has financed properties across the country with its bridge, HUD and mezzanine executions. The transactions do not represent a comprehensive list of transactions financed by Bravo but rather are a representative cross-section of closed financings.

Land Loan, Chapel Hill, North Carolina

Land Loan

200 Units Entitled

Market Rate Transaction

Multifamily Fixed Rate Financing, CT

HUD Loan

Multifamily – 66 units

Market Rate Transaction

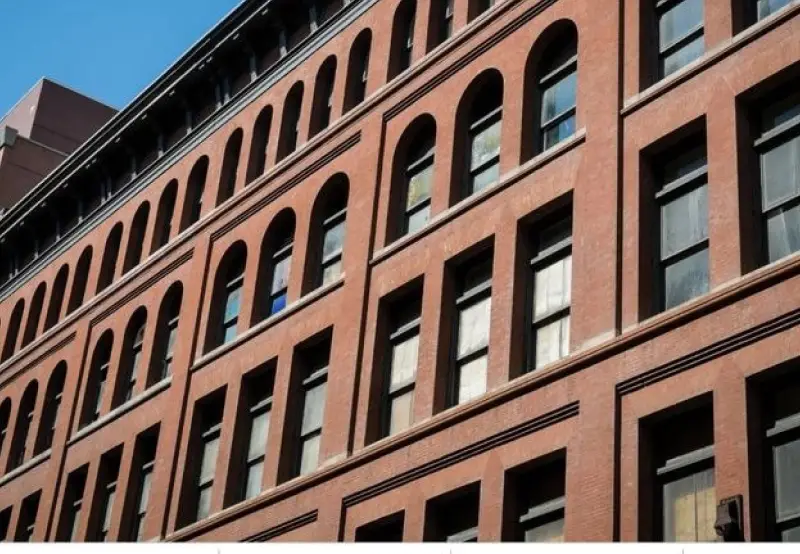

Energy Efficient Apartment Complex, NY

Bridge Loan and a HUD Loan

223 (f)

Market Rate Transaction

Health & Rehabilitation Center, Blountstown, FL

Bridge Loan

96 beds

Market Rate Transaction

Multifamily Financing, Tulsa, OK

Freddie Mac Loan

Multifamily – 208 units

Market Rate Transaction

Multifamily Fixed Rate Financing, Brooklyn, NY

HUD Loan

Multifamily – 58 units

Market Rate Transaction

Casa De La Rosa, St. Petersburg, FL

Bridge Loan

Multifamily – 62 units

Market Rate Transaction

1622 New York Avenue, Brooklyn, NY

Bridge Loan

Multifamily – 54 units

Market Rate Transaction

1622 New York Avenue, Brooklyn, NY

Bridge Loan

Multifamily – 54 units

Market Rate Transaction

Multifamily Financing, Jackson, MS

Bridge Loan

Multifamily – 441 units

Market Rate Transaction

Alora Bayonne, Bayonne, New Jersey.

Bridge Loan

Multifamily – 128 units.

Market Rate Transaction

50 Sussex Avenue Newark, New Jersey

Bridge Loan

Multifamily – 203 units

Market Rate Transaction

Journal Square, Jersey City, New Jersey

Construction Loan

Multifamily – 477 units

Market Rate Transaction

Licensed for Excellence in HUD, MAP, and LEAN Lending

HUD Approved

Bravo Capital is HUD approved nationwide.

MAP Approved

Our MAP approval enables our team to finance multifamily projects at competitive terms.

LEAN Approved

We have acclaimed LEAN underwriters leading to a focus on SNF and ALF financings.